- #Multiledger job setup for mac#

- #Multiledger job setup install#

- #Multiledger job setup software#

- #Multiledger job setup download#

If your software does not have an identified developer in the chart below, a quick web search of the software title should give you some clues on who to contact.

Still no luck? Get in touch with the developer of the software title to see if they can be of assistance.

#Multiledger job setup download#

You could always do a Google search to find other software that uses M元 files and download that to try to open your file. Please note that M元 file extensions may not be limited to Milestones 3.x Schedule or MultiLedger Chart of Accounts only. CheckMark MultiLedger is accounting software featuring General Ledger, Accounts Receivable, Accounts Payable, Inventory, Job tracking, and other features. CheckMark Cloud Backup Add-On Cloud Backup - 12 Months (+59. Software Delivery CD - 25.00 Digital Download 4. Software Plan CheckMark MultiLedger Software Pro+ (649.00) Change 2. If that didn't work, go into the file associations settings of Windows, and set Milestones 3.x Schedule or MultiLedger Chart of Accounts to open M元 files by default. CheckMark MultiLedger Accounting Software for Small Business CheckMark MultiLedger Software (5/5) 16 Reviews 1. But what if your software does not open the file?įirst, try right-clicking on the file and selecting "Open With." and select Milestones 3.x Schedule or MultiLedger Chart of Accounts from the dropdown list. Take care always.As you may already know, if you have Milestones 3.x Schedule or MultiLedger Chart of Accounts, you can simply double-click on your M元 and it should open up. Please let me know if you have other concerns.

It also includes popular articles and video tutorials in effectively managing your business with QuickBooks. To learn more about mixing personal and business finances in QuickBooks, I'm adding this article for further details: Why it’s best to keep your QuickBooks file all business. They can also further guide you on what other options that's best in handling your personal and business expenses.

#Multiledger job setup for mac#

However, the information can be a reference for QBDT for Mac as well.Īdditionally, I'd recommend consulting your accountant to ensure your books are accurate. You can also use Profit Centers to keep track of different jobs or. You can check out this article for further details: Pay for business expenses with personal funds. This link is for QuickBooks Online (QBO). You can use MultiLedger to set up jobs or projects and track their income and expenses. An example of this is to send yourself a bill or invoice, then pay and receive its payment to complete the process. It isn't necessary to start an additional company in QBDT for Mac since there's a proper way of recording your expenses without combining your business and personal accounts. This is to help you make good business and personal financial decisions. Here in QuickBooks, we always recommend not to mix your personal and business expenditures. I'm here to share details about handling your business and personal accounts in QuickBooks Desktop (QBDT) for Mac, This way, you'll be able to determine the action you need to take care of this. Thank you for your help and forgive me for my lack of knowledge when it comes to principles of accounting!

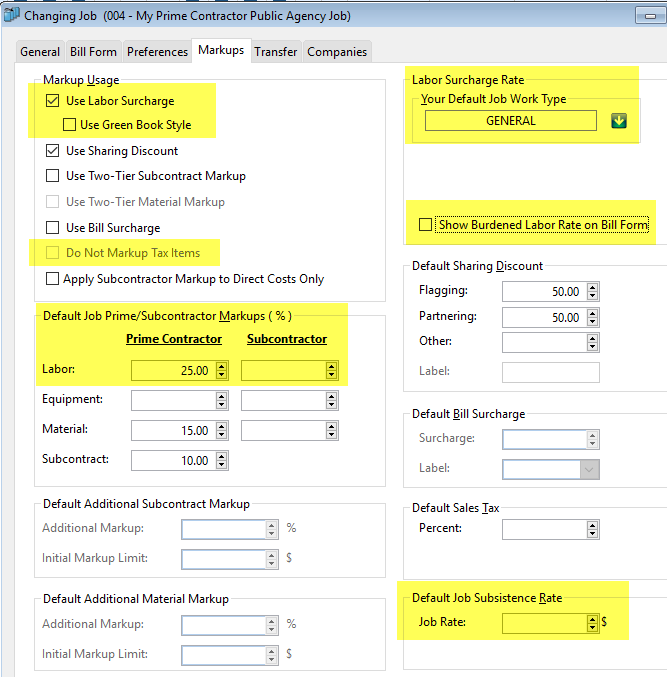

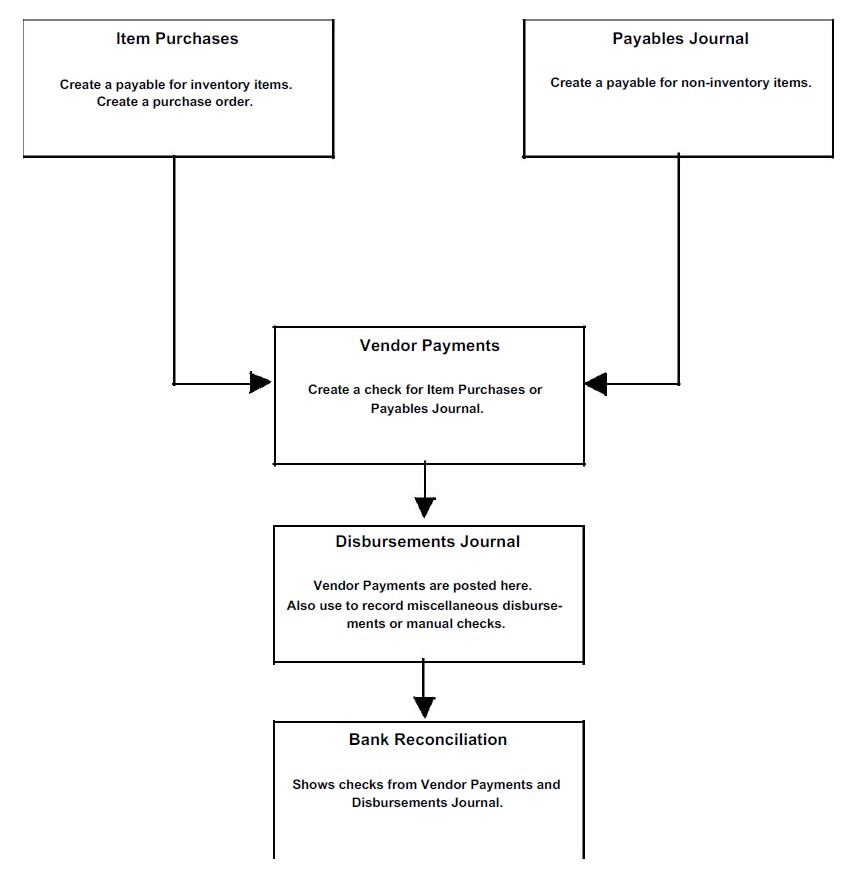

if the above is possible, are there any reasons why i shouldn’t do it? (a reason why i’d like to do it is so that i don’t have to always open up and work in 2 different qb ledger “companies”) item - job The only software offering - setup setup Charges Reconciliation Reports Reports - t t - d t setting up MultiLedger, we - Instantaneous. can i (should i?) then set up chart of accounts for expenses, like “utilites – personal” where my personal checking account assigns payments to those accounts? can i set things up so i can keep those payments separate for my business reports? can i set up a chart of account in my business qb ledger and use it for my personal checking account, but somehow have it not affect my business profit and loss statements etc?… i sometimes transfer money from my business checking account to my personal checking account for personal expenses reimbursement, and also to pay myself for owner’s draw pay for personal percentages of business expenses since i work from home, so for example: i pay 50% of my utlility bills from my personal checking account (and 50% from my business checking account) I’m switching to quickbooks from another program (multiledger) and i used to have and use a separate multiledger “company” set up just for balancing my personal checking account, but i’m wondering if i can and should now meld the personal bookeeping into my qb business ledger?… I do wish it had a job costing that was not attached to the MultiLedger. MultiLedger is fully integrated, multi-user and cross-platform software for Mac and Windows.

#Multiledger job setup install#

Hi, i have a small business (an llc but i am the sole proprietor and i file a 1040 schedule c for the business)… Then, the install lost the old company databases which had to be reimported.

0 kommentar(er)

0 kommentar(er)